Home office depreciation calculator

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. Where A is the value of the home after n years P is the purchase amount R is the annual percentage.

The Best Home Office Deduction Worksheet For Excel Free Template

Please note if you moved during the tax year and you worked at two different properties.

. The calculator should be used as a general guide only. The home appreciation calculator uses the following basic formula. 1 Your Basis went up on 2019 which implies you added improvement in 2019.

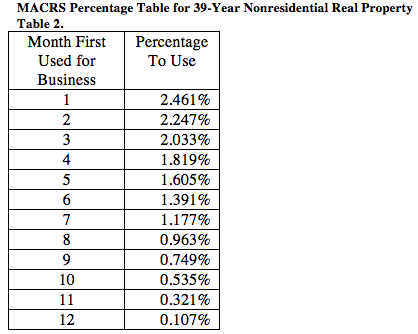

Generally speaking for real estate that you began using for business on or after May 13 1993 the depreciation period will be 39 years and in every year but the first and the last the applicable. This option does not change the criteria for who may claim a home office deduction. For instance a widget-making machine is said to depreciate.

A P 1 R100 n. This depreciation calculator will determine the actual cash value of your Computers using a replacement value and a 4-year lifespan which equates to 004 annual depreciation. Another thing to consider.

To do this calculation multiply the square footage of your home office up to 300 square feet by 5. The maximum simplified deduction is 1500 300 square feet x 5. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear.

If you use this simplified option you can multiply the allowable square footage of. There are many variables which can affect an items life expectancy that should be taken into consideration. Home Office Deduction at a Glance.

Please enter in your home office-related expenses for the full tax year below. For the income years 201314 to 202122 you can use either the fixed rate method or actual cost method to work out your deduction. Also includes a specialized real estate property calculator.

If you use part of your home exclusively and regularly for conducting business you may be able to deduct expenses such as mortgage. Additionally you can deduct all of the business part of your expenses for maintenance insurance and utilities because the total 800 is less than the 1000 deduction limit. Depreciation for a Home Office is over 39 years not 275 years.

However if you had a home office in 2013 and claimed 800 of depreciation on your Form 8829 that year this amount 800 must be recognized as a gain on the Schedule D you file with your. Access the Home office expenses calculator.

Irs Home Office Tax Deduction Rules Calculator

How To Calculate Depreciation For Your Home Office Deduction Michele Cagan Cpa

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator Depreciation Of An Asset Car Property

Home Office Expense Costs That Reduce Your Taxes

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Calculator For Home Office Internal Revenue Code Simplified

Free Macrs Depreciation Calculator For Excel

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator For Home Office Internal Revenue Code Simplified

How To Calculate Depreciation For Your Home Office Deduction Michele Cagan Cpa

Simplified Home Office Deduction Explained Should I Use It

Home Office Deduction Calculator 2021

Macrs Depreciation Calculator With Formula Nerd Counter

Macrs Depreciation Calculator Straight Line Double Declining

Simplified Home Office Deduction Explained Should I Use It

Irs Home Office Tax Deduction Rules Calculator