48+ what is the debt to income ratio for a mortgage

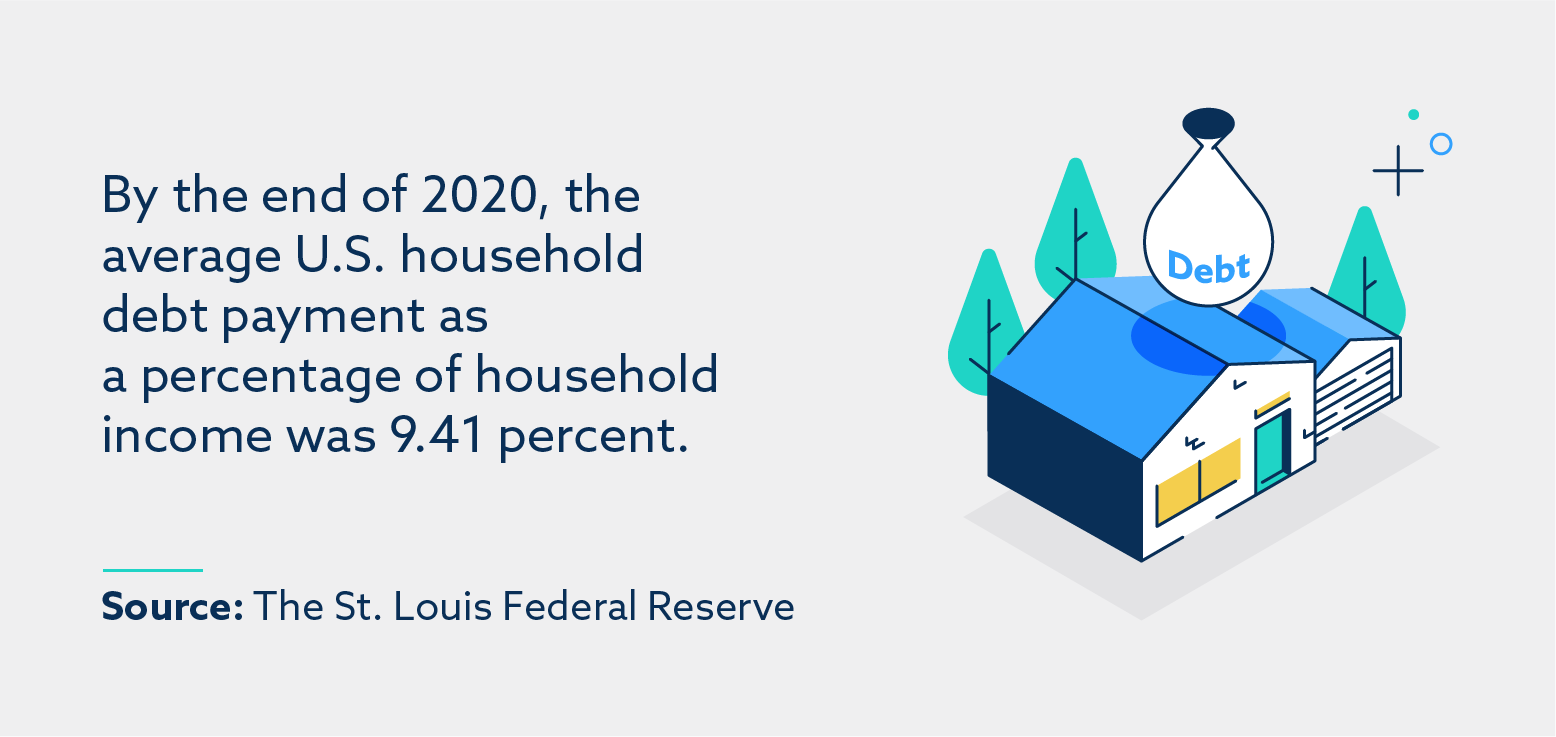

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web Debt-to-income DTI is the percentage of your income owed to debt service each month.

Debt To Income Dti Ratio What S Good And How To Calculate It

Unlock Your Home Equity Today in Exchange for a Percentage of Your Homes Future Value.

. Low Credit No Problem. Ad Compare Mortgage Options Calculate Payments. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend.

Web For someone who owes 2000 in debt each month and earns 5000 in wages the equation would look like this. 43 to 50 FHA loans. You have a pretax income of 4500 per month.

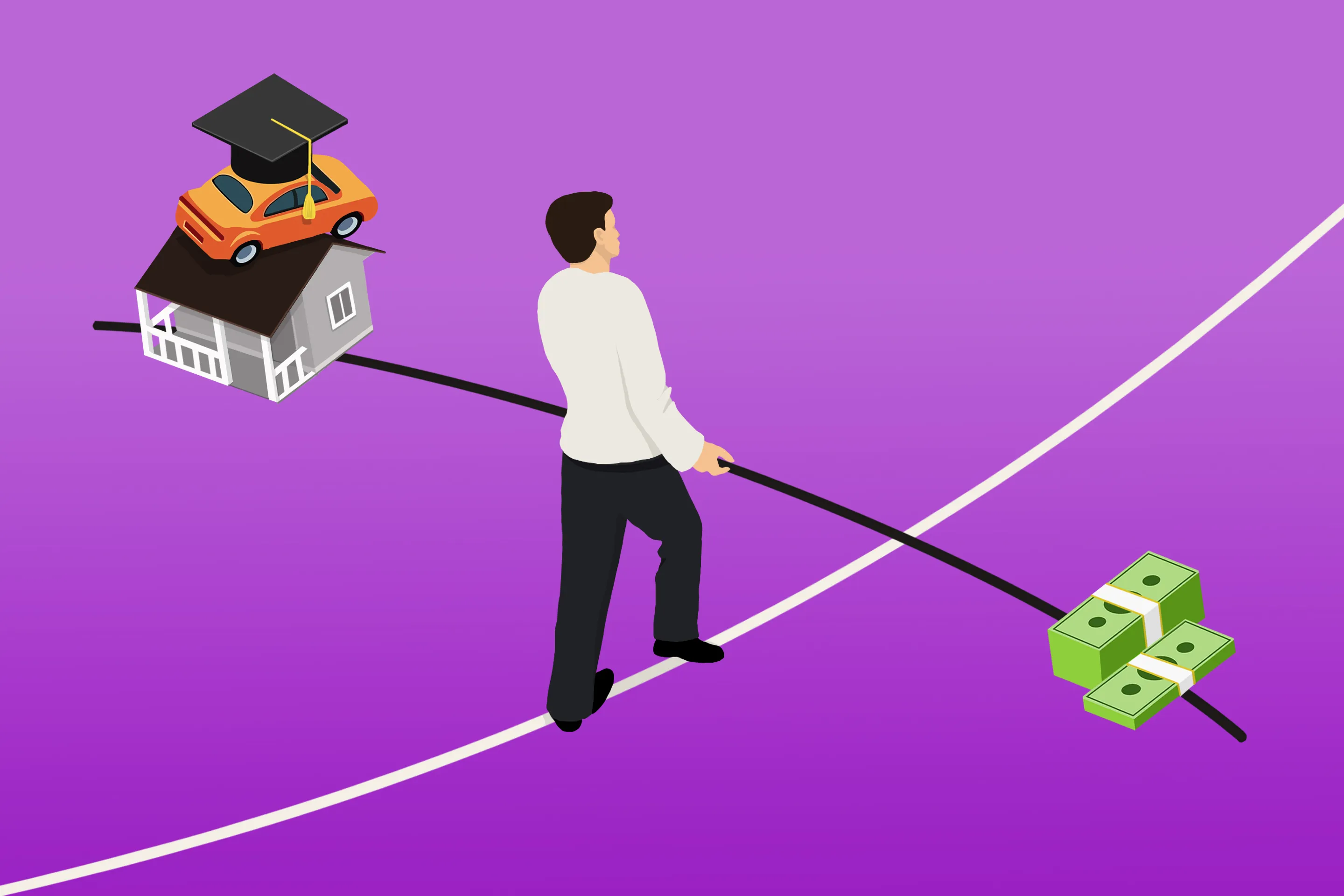

Ad Learn if You Qualify in 2 Minutes or Less. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032.

Web Debt-to-income ratio total monthly debt paymentsgross monthly income. Apply Now With Quicken Loans. This means all of your debts cannot take up more than 43 of your gross.

Web Your debt-to-income ratio or DTI for short is the percentage of your gross monthly income that goes toward debt payments. Web Here are the common maximum DTI ratios for major loan programs. Lets say you and a friend both earn 10000 each month before.

Compare Mortgage Options Get Quotes. Lenders prefer to see a debt-to. Unlock Your Home Equity Today in Exchange for a Percentage of Your Homes Future Value.

Web If your housing-related expenses are 1000 and your gross monthly income is 3000 your front-end DTI would be 33 10003000033. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web Lenders calculate your debt-to-income ratio by dividing your monthly debt obligations by your pretax or gross income.

Use Funds for Anything. Apply Now With Quicken Loans. Web Expressed as a percentage a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income.

Ad Learn if You Qualify in 2 Minutes or Less. Your DTI or debt-to-income ratio is based on two numbers. Banks and lenders have different acceptance.

Get Instantly Matched With Your Ideal Mortgage Lender. Use Funds for Anything. Web Your debt-to-income ratio is a measurement lenders use to find out how much of your income goes toward paying off debt every month.

Web How to calculate debt-to-income ratio. Compare Mortgage Options Get Quotes. Low Credit No Problem.

Highest Satisfaction for Mortgage Origination. Most lenders look for a ratio of 36 or less although. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage.

Apply Online To Enjoy A Service. Multiply that by 100 to get a. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Ad Compare Mortgage Options Calculate Payments. Web According to the Qualified Mortgage Guidelines your total debt ratio cannot exceed 43. 45 to 50 VA loans.

Lock Your Rate Today. Your total debt divided by your gross monthly income. Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis.

Get Started Now With Quicken Loans. Get Started Now With Quicken Loans. Web Debt-to-Income Ratio Calculator.

Web Key Takeaways. Ideally lenders prefer a debt-to-income ratio lower. It considers all your.

Your debt-to-income ratio DTI is your total liabilities and debts divided by your gross yearly income. Ad Compare the Best Home Loans for February 2023. Apply Get Pre-Approved Today.

For example if you earn 5000 per. Save Real Money Today. Your monthly expenses include 1200.

2000 5000 x 100 40 DTI To calculate. Ad Calculate Your Payment with 0 Down.

Debt To Income Ratio Calculator Properbuz

Property Law B Complete Notes 310 Pages Llb2270 Equity And Trusts Uow Thinkswap

Debt To Income Ratio Calculator United Mortgage Corp

How To Calculate Your Debt To Income Ratio For A Mortgage

How Hmda Plus Data Is Changing Fair Lending Analytics

:max_bytes(150000):strip_icc()/GettyImages-463012867-572e2cbb5f9b58c34c8fa655.jpg)

What Is A Good Debt To Income Dti Ratio

What Is Debt To Income Ratio How Do I Calculate My Dti

What Is An Acceptable Debt To Income Ratio Hoyes Michalos

![]()

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Calculating Your Debt To Income Ratio How To Guide

How To Calculate Debt To Income Ratio For A Mortgage Or Loan

What S Considered A Good Debt To Income Dti Ratio

What Debt To Income Ratio I Need To Buy A Home Big Block Realty

What Is A Debt To Income Ratio Consumer Financial Protection Bureau

Debt To Income Dti Ratio Calculator Money

What Is The 28 36 Rule Lexington Law

Mortgage Income Requirements In 2015 Influenced By Government Rules